Keypoints:

"0% Normal Sales Charge, Really?"

The normal sales charge for equity funds through sales agents is 5-6.5%, while investing using your EPF savings entitles you to a sales charge of 3%. Here on Fundsupermart.com, we claim to be among the lowest with normal sales charge on equity funds capped at 2%.

Even lower still are funds with 0% normal sales charge, and here are the ones on our platform.

| Table 1: Funds With 0% Normal Sales Charge | |

| Fund Name | Sector |

| InterPac Dana Safi | Malaysia |

| InterPac Dynamic Equity Fund | Malaysia |

| MIDF Amanah Asia Pacific Equity Fund | Asia excluding Japan |

| MIDF Amanah Asia Pacific Islamic Equity Fund | Asia excluding Japan |

| MIDF Amanah Dynamic Fund | Malaysia |

| MIDF Amanah Growth Fund | Malaysia |

| MIDF Amanah Islamic Fund | Malaysia |

| MIDF Amanah Strategic Fund | Malaysia; Small to Medium Companies |

| Source: Fundsupermart | |

"What So Good About A 0% Normal Sales Charge?"

Because investors do not need to incur a sales charge, 100% of their investment is put into the fund, instead of incurring a 5% expense when buying via a sales agent, for instance, and investing only 95% in the fund.

5% might not be much but if you invest regularly to meet your investment objectives, the sales charges do add up. Thinking of it another way, the 5% is a loss that investors would need to recover from their fund’s performance.

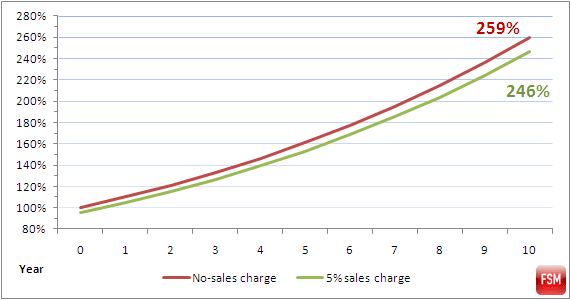

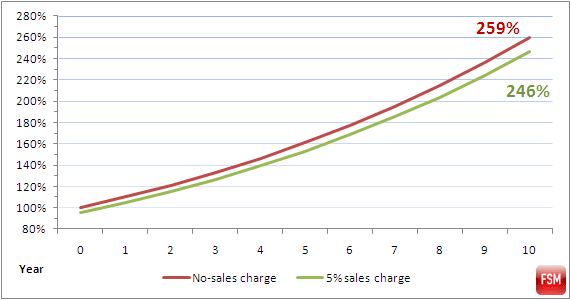

Also, using a hypothetical example of a fund which gives a 10% return per annum, the 5% difference in the initial investment amount will expand into a 13% difference after 10 years. As more time passes, the difference becomes bigger.

| Chart 1: Hypothetical 10% Return Per Annum |

|---|

|

| Source: Fundsupermart |

“No Sales Charge, But An Increase In Expenses Elsewhere?”

Though there are no sales charges, there are still recurring expenses borne by investors, just like any other unit trust. These recurring expenses (or annual expenses) have already been deducted in arriving at a fund’s NAV.

| Table 2: Expense Ratio | ||||

| Fund Name | Annual Management Fee |

Management Expense Ratio |

Fund Size (end June 2011) |

Redemption Fee* |

| InterPac Dana Safi | 2.0% |

2.94% (as of March 31, 2011) |

RM 1.34 million |

1.0% |

| InterPac Dynamic Equity Fund | 2.0% |

2.77% (as of March 31, 2011) |

RM 1.56 million |

1.0% |

| MIDF Amanah Asia Pacific Equity Fund | 1.8% |

N/A |

N/A |

1.8% |

| MIDF Amanah Asia Pacific Islamic Equity Fund | 1.8% |

N/A |

N/A |

1.8% |

| MIDF Amanah Dynamic Fund | 1.5% |

2.31% (as of March 31, 2011) |

RM 4.51 million |

1.5% |

| MIDF Amanah Growth Fund | 1.5% |

1.69% (as of April 15, 2011) |

RM 25.07 million |

1.5% |

| MIDF Amanah Islamic Fund | 1.5% |

1.71% (as of June 15, 2010) |

RM 21.81 million |

1.5% |

| MIDF Amanah Strategic Fund | 1.5% |

1.66% (as of January 15, 2011) |

RM 47.64 million |

1.5% |

| *applicable if the unit holder redeems the units within 1 year of purchase. Source: Fundsupermart |

||||

The second column of Table 2 above shows the annual management fee that the fund manager can charge. In practice, not all fund managers charge the maximum amount. Inter-Pacific Asset Management Sdn Bhd, for instance, has charged annual management fee of only 1.0% per annum based on daily NAV for the year ended 31 March 2011.

Besides the annual management fee, a fund also incurs other expenses such as the trustee’s fee, auditor’s remuneration, tax agent’s fee and other administrative expenses.

Investors need to look at a fund’s management expense ratio (MER) to get an idea of how much total expenses they are paying. The average MER of Malaysia Equity funds on our platform is around 1.80% (based on latest data available as of date of writing).

As such, there is no notable increase in the MER of no-sales charge funds compared to our average MER; however, the MER of the smaller-sized funds is among the highest due to fixed expenses which are relatively costly when the fund size is small.

“Why Don’t These Funds Have Sales Charge?”

To answer this question, we have asked fund managers of both MIDF Amanah Asset Management Berhad and Inter-Pacific Asset Management Sdn Bhd.

Scott Lim

“It is our fundamental belief that 100% of investors’ capital should be invested. In fact, Investors should demand that their capital be invested fully at all times. As we all know, the fund manager earn its fees through annual management fees over the investment period anyway. Other than charging performance fees after delivering performance better than benchmark, there should not be other charges. In our view, costs involved in securing the business should be absorbed by the fund manager as it is part of the business costs. It is a case of benefitting the investors first, so that the fund manager will gain.”

Robbin Khoo

“The primary benefit for the fund house is the potential increase in business volumes as well as the client base. All things being equal, the 0% sales charge would definitely provide a competitive edge in the market. It must be reiterated however, that this is NOT the only criteria in an investment decision of an investor. Therefore, while this provides a competitive advantage, it does not guarantee increased sales by the fund house. To further add, having a 0% sales charge allows the fund house to expand its distribution options. Often this advantage provides for the incorporation of direct-marketing initiatives where intermediaries may be absent. Thus, from a marketing perspective, it allows the fund house to expand and integrate its distribution options via more dynamic channel management strategies.”

Summing It Up

Besides looking at the sales charge and recurring expenses, investors should also look into the other aspects well, namely the performance (e.g. historical returns, under/outperformance vs benchmark) and risk (e.g. downside risk, Sharpe ratio) aspects of a fund through good and bad times.

Nevertheless, a penny saved is a penny earned. If you are an investor that is looking to save on investment costs, these no-sales charge funds should be on your shortlist!

Related Articles

Malaysia: Heightened Risk Aversion, Focus on Fundamental

Fund Focus: MIDF Amanah Strategic Fund

| The Content Team is part of iFAST Capital Sdn. Bhd. |

| This article is not to be construed as an offer or solicitation for the subscription, purchase or sale of any fund. No investment decision should be taken without first viewing a fund's prospectus and if necessary, consulting with financial or other professional advisers. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Past performance and any forecast is not necessarily indicative of the future or likely performance of the fund. The value of units and the income from them may fall as well as rise. Opinions expressed herein are subject to change without notice. Please read our disclaimer in the website. |

|